As a real estate professional, I have the opportunity to speak daily with homeowners and investors alike. One question investors often ask is “Do you have any good deals?” On the surface, this would seem to be a reasonable question – after all, nobody wants a bad deal, right? To best assist, I usually respond to this question by asking, “What type of returns are you looking for, and what is your risk profile?” In between the occasional well thought through responses from seasoned investors, my questions are often met with the dreaded “deer in headlights” paralysis. For this reason, I am devoting my very first issue of Real Estate Dollars and Sense to providing a framework around which to analyze real estate investment returns.

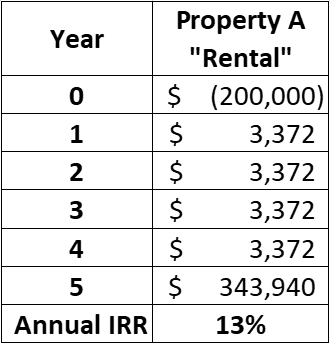

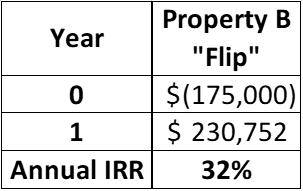

Let’s assume that two real estate investment opportunities came across your desk, Property A (aka the "Rental") and Property B (aka the "Flip"), where each has the following investment profile:

Which property (if any) should you invest in? To answer this question, at a minimum, one should consider the relative returns of both properties and one's tolerance for risk relative to each investment. Let’s take a closer look at the above factors. To compare the relative returns of both properties, one useful metric is the Internal Rate of Return (IRR). According to Wikipedia, the internal rate of return on an investment is the "annualized effective compounded return rate" that sets the net present value of all cash flows (both positive and negative) from the investment equal to zero. Thinking about the IRR intuitively, the way to maximize your annualized effective compounded rate of return (or IRR) is to maximize your cash flow (through some combination of monthly rents and/or appreciation at sale) over the shortest hold/ownership period, while minimizing your cash outlay on Day 1 (i.e. your down payment). To calculate the IRR of the two investment opportunities above, the cash flows (both positive and negative) for each year during the hold period are required as shown in the below T-bars.

The negative dollar amount in Year 0 for Property A represents the down payment, while the positive annual cash flows in Years 1 through 4 represent the net cash flow resulting from the rental income less any operating and mortgage expenses. The Year 5 cash flow for Property A represents the same net cash flow seen from rents in Years 1 through 4, plus the proceeds received from the sale of the property less the loan balance payoff and any expenses associated with the sale. Similarly, for Property B, the negative cash flow in Year 0 represents the down payment, while the Year 1 cash flow represents the proceeds received from the sale of the property less the loan balance payoff, expenses associated with the sale, operating and mortgage expenses for the year and lastly, the renovation costs. Using your favorite financial calculator app (or IRR function in Excel), you can now enter these annual cash flows and calculate the IRR for each investment opportunity. As shown in Tables 2 and 3, respectively, the IRR for Property A (aka the “Rental”) is 13% per year while the IRR for Property B (aka the “Flip”) is 32% per year.

At this point, you might think that this is a no-brainer – not so fast! Keep in mind that consistent with the correlation between expected returns and degree of risk, Property B (while 2.5X the potential annual return of Property A) also means zero income for the year while paying operating expenses, mortgage expenses, and renovations costs with the hope of selling for $200K above your purchase price within one year. Possible? Absolutely – but let’s look at the fragility of this plan from a different point of view. Consider a modest market correction by 3.9% in the year of sale. This would mean that instead of selling Property B for $900K, you would only be able to achieve a sale price of $865K. While the impact of this may not seem prohibitive, this small correction changes the annual IRR of Property B from 32% to … yep, you guessed it, 13% - the same annual IRR as Property A! The above analysis demonstrates why I strive to learn more about an investor's return objectives and risk profile when asked about any potential real estate investment opportunities. In some cases, Property A might best fit a client's investment profile, while in other cases, Property B may be the best fit. What are your real estate investment objectives?

Create an Account

Search the MLS and featured property listings in real time.